Hip Hop Star/Entrepreneur Lupe Fiasco and Angel Investor/Google Waze Exec Di-Ann Eisnor’s Neighborhood Start Fund is a laudable initiative that embodies innovative approaches to help revitalize distressed communities through private investment and entrepreneurship. Admirably, despite the oft-expressed skepticism, Fiasco and Eisnor have a strong conviction – which we share – that, but for, the unique challenges talented would-be entrepreneurs in these communities face with regard to access to patient capital, networks, etc., they can build successful businesses that will have substantive and sustainable economic impact in their neighborhoods. Given the limited public funding available and the limitations of traditional philanthropy, there are strong prospects that Fiasco and Eisnor’s fund and other recent efforts to foster black entrepreneurship, many of which are largely powered by African Americans themselves, will help to transform our distressed communities over the next few years. The expected substantial growth of the burgeoning impact investing sector and public policy developments such as President Obama’s “Promise Zones” initiative and the bipartisan “Investing in Opportunity Act” recently introduced in Congress will further boost such prospects.

The Neighborhood Start Fund, co-founded by Grammy Award-winning hip-hop star and entrepreneur Lupe Fiasco (real name: Wasalu Muhammad Jaco) and Di-Ann Eisnor, an angel investor and Google Waze executive, is, according to its website, a “neighborhood-specific fund” that is “kick-starting neighborhood-based entrepreneurship.” It will “turn ideas into start-ups” and “support entrepreneurs and start-ups from underserved areas… so the best new ideas won’t go wasted.” The fund will provide entrepreneurs with access to resources, networks, workshops, mentoring, and funding.

The announcement of the fund (in October 2015) received significant positive coverage in black, music, entertainment, and business media (see links to some of the articles/blogs below).

Citing his co-founding of the fund, Ebony magazine honored Fiasco as one of the 2015 Ebony Power 100 Heroes of the black community. In a tweet thanking the magazine for the honor, Fiasco proclaimed: “And we’re just getting started!”. Indeed, starting with the Brownsville neighborhood in Brooklyn, New York, he and Eisnor plan to expand the initiative to several neighborhoods, up to a dozen by the end of 2016. According to the website, each neighborhood fund will be a “local micro-economic engine” that will have “hyper local economic impact.” A key goal is to create the “first $100MM+ business from our neighborhoods!”

In a Fast Company interview, Fiasco and Eisnor, who reportedly pooled one million dollars to start the fund, bullishly and compellingly addressed the oft-expressed skepticism about prospects for entrepreneurship and business success in inner-city neighborhoods:

“Brownsville is just the beginning,” says Fiasco. …Eisnor says that the fund is emphatically not a philanthropic venture. “It’s very important to me that this is not philanthropy, that we have real economic engines and real wealth coming to these neighborhoods… If one success comes out of this, then other investors will take it seriously. We want to be the on-ramp to something more sustainable.”

She has a serene certainty that it will work. “It’s totally faith-based, as was Waze, as was everything I’ve done… My personality is really intuitive. If I have a sense that something needs to happen, I’m going to make it happen.”

In addition to crime and other urban problems, neighborhoods like Brownsville often suffer from underfunded public schools and low educational attainment. What does Eisnor say to a skeptic, then, who might wonder if Brownsville residents have been adequately trained to found a $100 million company? “My first statement is: So? You don’t have to believe it. We’ll prove it. I’d also say that some of the best companies are from people who didn’t get to finish their education. Being an entrepreneur is more about being stubborn, tenacious, hard-working, and focused, rather than having any specific skill set.”

According to the article, Eisnor and Fiasco were motivated by “shared concerns: inequality in America, ghettoized neighborhoods, and the lack of diversity in the innovation economy” and “had a shared belief that good ideas could come from anywhere, and began to wonder whether there wasn’t a way to start hunting for business ideas—and funding them—in neglected neighborhoods around the country.”

In partnership with the Dream Big Foundation, the fund held its first business pitching competition, in Brownsville, on November 13, 2015. Winners and finalists received various prizes in the form of seed funding as well as access to other resources, networks and mentorship (see reports on the event here: Lupe Fiasco’s Looking for the Next Big Idea in the Inner-City and The Dream Big Foundation Rewards Entrepreneurship in the Inner City).

The Neighborhood Start Fund addresses a critical challenge in distressed communities: talented would-be entrepreneurs often lack access to start-up or early-stage capital and the requisite networks because they — as well as families and friends, the initial external sources of seed capital entrepreneurs typically rely on — have low levels of wealth and other resources (see, e.g.: Robert Fairlie, Alicia Robb, and David T. Robinson, “Black and White: Access to Capital among Minority-Owned Startups”; Timothy Bates and Alicia Robb, “Minority-Owned Businesses Come Up Short in Access to Capital: It’s Time to Change the Equation for MBEs”). Thus, without the necessary seed capital, they are unable to get sufficiently established to obtain external financing from angel investors, venture capitalists, or lending institutions. Thus, more initiatives such as the Neighborhood Start Fund would help to address this critical need.

We of course laud Fiasco and Eisner’s ambitious and inspiring endeavor and share their conviction and optimism. Indeed, regardless of how their initiative turns out, it should already inspire other celebrities — especially those with roots in or other strong connections to under-resourced neighborhoods — to establish similar initiatives in their communities of origin and/or where they work or reside.

Of course, many black celebrities (artists, entertainers, athletes, entrepreneurs, finance/corporate titans, and other accomplished or influential public figures) already are philanthropists and contribute generously to various causes through their own foundations or other charitable initiatives (see Chapters 2, 3 and 4, on Black Philanthropy and Resource Pooling, here and several reports at BlackGivesBack.com and BlackCelebrityGiving.com).

However, apparently very little of such efforts has focused on investments in entrepreneurship and accountable for-profit ventures that would have more robust, measurable, sustainable and scalable impacts – through job creation, poverty reduction, wealth building, and enhancement of the entrepreneurial spirit – than traditional charitable giving to nonprofit organizations. As is well-recognized, while some nonprofits obviously do great work, most are scattered, small-scale efforts whose actual impacts are often difficult to measure–many lack transparency and scalability and are not cost-effective.

To be sure, some black celebrities have been engaged in initiatives to help foster black entrepreneurship—for example, Grammy Award-winning songwriter/producer Bryan Michael Cox and music star and entrepreneur Sean Combs were involved with 100 Urban Entrepreneurs (which, unfortunately, appears to have discontinued operations). However, as far as we have been able to determine, no one has taken a bold and proactive step such as Fiasco’s with an endeavor that is specifically targeted to distressed communities, and with the intended impact on the ambitious scale that he and Eisnor envision.

In this regard, one approach proposed by Dr. Michael Isimbabi in his 2014 book, Pooling Our Resources to Foster Black Progress: An Entrepreneurship and Impact Investing Framework, is a collaboration among celebrities, angel investors, philanthropists, foundations, etc. to establish a primarily for-profit impact investment fund that is specifically targeted to underserved communities, the Excellence and Ventures Transformation Fund (or “EXCEL-TRANSFORM Fund”). (Disclosure: Dr. Isimbabi is affiliated with BlackProgress.com.)

In order to achieve national scale and greater impact in numerous communities across the country, the Fund would expand by galvanizing large numbers — potentially millions — of African Americans (as well as non-African Americans) to invest in addressing the most critical aspects of the access-to-capital problem, i.e., by providing patient start-up/seed capital to for-profit businesses as well as nonprofits that clearly demonstrate the potential to have high impacts on communities. These would necessarily be entrepreneurial ventures that can reduce unemployment and poverty while profitably providing needed services in areas such as education, job training, early childhood development, affordable housing, healthcare, retail, energy, etc.

In addition to the social returns from the positive impact on communities, investors would obtain financial returns, which could be below or at market-rate (see “Investing With Purpose: Unlocking the Economic Potential of Impact Investments” (Bay Area Council Economic Institute)). Compared to traditional charitable giving, the likelihood of financial returns would incentivize much greater amounts of capital flows to finance ventures in these communities, especially from impact investors who would accept below-market returns in exchange for tangible social impact, e.g., philanthropists who already give back to help uplift the communities. Thus, even if expected financial returns are below-market-rate, the Fund would still attract impact investment capital at levels that are multiple times the amounts that would normally be available through traditional charitable giving only. As further discussed below, the impact investment sector is expected to grow substantially over the next few years.

Clearly, as a unique source of financing and support that specifically addresses start-up capital challenges, the Fund would foster the emergence of many more entrepreneurs and innovators who have the talent and motivation to build successful businesses that will positively impact communities, but who otherwise would be unable to do so because they have limited seed capital and other critical resources. The Fund could start on a small pilot-scale in one or two distressed areas and then grow over a few years into a large national fund that would finance ventures in several such communities across the country. Such geographical (in addition to sectoral) diversification of the Fund’s investments would, of course, lower overall risk for investors.

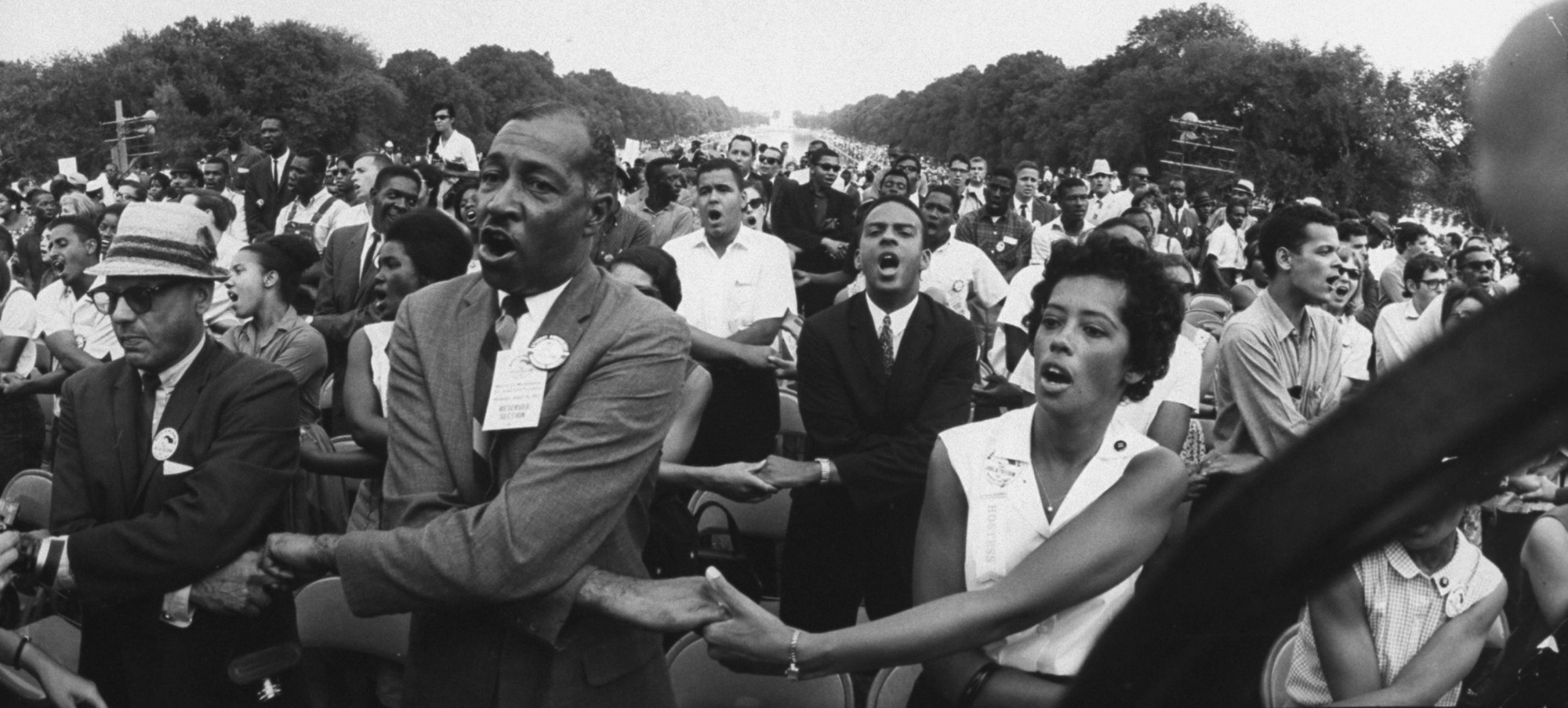

While acknowledging the challenges associated with implementing an initiative such as the Fund — in particular, overcoming the “trust barrier” and skepticism about feasibility and galvanizing large numbers of investors — Isimbabi argues that such a self-reliance driven resource-pooling effort is feasible. He also couches the challenge in terms of the “unfinished business” of the civil rights movement (see “Obama Calls on Nation to Complete Dream’s ‘Unfinished Business’” (TheHill.com)), i.e., enhancing economic opportunity and reducing persistent racial economic disparities. Thus, the concept of the Fund could be viewed as the 21st century extension of the movement and thereby a source of motivation for, and basis for galvanizing, large numbers of people to invest in the Fund.

(See the Appendix below for excerpts from Isimbabi’s book and his Living Cities blog article, After Baltimore: Revitalizing Distressed Communities through Impact Investing and Entrepreneurship (Part III): How Engaged Celebrities and Other Philanthropists, as “Pioneer Investors,” Can Jump-Start an Impact Investment Fund and Galvanize Other Investors and Communities, on the rationale and implementation strategy of the EXCEL-TRANSFORM Fund and how Fiasco/Eisnor’s initiative is consistent with the concept of the Fund.)

Encouragingly, several other initiatives aimed at boosting black entrepreneurship — especially among youth and in tech — have emerged in recent years. These include, for example: NewME, Black Founders, Impact America Fund, Powermoves, Black Angels, Blacktech Week, Black Tech Mecca, All Star Code, Black Girls Code, CODE2040, #YesWeCode, the Hidden Genius Project, Walker’s Legacy, Urban Co-Lab, Opportunity Hub, 100 Urban Entrepreneurs, the National Urban League’s Entrepreneurship Centers, and the Thurgood Marshall College Fund’s Opportunity Funding Corporation. [For more information on such initiatives, see: Black Tech Entrepreneurship: Insights, Perspectives, Initiatives and Trends (BlackProgress.com).]

Furthermore, the impact investing sector is expected to grow substantially in the next few years (Jean Case, “The State Of Impact Investing: Is It A Houseboat Or Is It Brunch?”). Given the limited public funding available to address social problems in poor communities, it is expected that some of the substantial amounts of private capital that will be unlocked will be available for investment in ventures in these communities that are profitable enough to provide adequate financial as well as social returns to investors.

In this regard, many foundations and financial firms are already becoming increasingly involved in impact investment in underserved communities. Examples of initiatives in this regard include: Benefit Chicago; Living Cities’ Blended Catalyst Fund; Ours To Own (in Baltimore, Denver, Minneapolis/St. Paul); Venture Jobs Foundation (Rochester, NY); the Case Foundation’s Impact Investing and Inclusive Entrepreneurship initiatives; JPMorgan Chase’s initiatives in Detroit and other cities; Goldman Sachs Impact Investing; Forward Cities and the Initiative for a Competitive Inner City.

There are also encouraging developments on the public policy front. The Obama administration is a strong proponent of impact investing. In June 2014, the White House hosted a roundtable on impact investing, during which “senior Administration officials met with more than 20 private-sector investors answering the President’s call to action by announcing their new commitments to make more than $1.5 billion in investments that intentionally generate sound financial return as well as measurable social or environmental impact. New Administration actions will catalyze additional private sector impact investments and support these companies and entrepreneurs.” Also, President Obama’s “Promise Zones” initiative is intended to revitalize high-poverty communities across the country by attracting private investment, boosting affordable housing, increasing educational opportunities, and providing tax incentives to stimulate investment in the Zones and encourage hiring of workers.

Furthermore, in April 2016, a bipartisan, bicameral group of legislators, Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI), introduced in Congress the Investing in Opportunity Act, which, if passed, will provide tax and other incentives to stimulate private investment in distressed communities. According to the legislators’ joint statement, the proposed legislation is a “new approach to connecting struggling communities with the private investment they need to thrive. By empowering investors around the country to pool their resources in Opportunity Funds, we can dramatically expand access to the capital and expertise needed to start and grow businesses, hire workers, and restore economic opportunity in struggling communities…. The Opportunity Funds created by this legislation will provide a high-impact source for funding new businesses, developing blighted properties, investing in local infrastructure projects, financing facility construction or refurbishment, and a host of other activities to enhance the local economic ecosystem and create new opportunities for local residents.”

Senator Booker also noted: “…[B]arriers stand between too many communities and access to the capital needed to generate economic growth and opportunity. In an era of capital moving overseas or going towards uses that don’t maximize opportunity for most Americans, our bipartisan legislation will help lower these barriers and jumpstart economic development and entrepreneurship by stimulating the flow of investment into the communities that need it most, from Camden to Newark and beyond….”

Other recent policy and regulatory developments that are expected to boost growth in the impact investing include:

- The Treasury Department/Internal Revenue Service’s new guidance to private foundations on Program-Related Investments (PRIs), which removes some of the uncertainty about impact investing among foundations by confirming new examples of the types of investments that qualify as PRIs.

- The Labor Department’s new guidance on Economically Targeted Investing made by retirement plans covered by the Employee Retirement Income Security Act, which, according to the Case Foundation’s Jean Case, could potentially “put the pedal to the metal for impact investing”.

- The Securities and Exchange Commission’s adoption of rules to permit equity crowdfunding under Title III of the Jumpstart Our Business Startups (JOBS) Act (“Regulation Crowdfunding”), which is expected to increase access to capital in relatively small amounts through online crowdfunding platforms.

Of course, given the lingering, but often erroneous or exaggerated, negative stereotypes and high risks associated with investing in distressed communities, the extent to which impact investing capital will actually flow to finance ventures that will reduce unemployment and poverty in the most distressed communities remains to be seen.

Nonetheless, there is good reason to be optimistic about entrepreneurship-based efforts by innovators and champions — such as Fiasco/Eisnor’s and others cited above — who genuinely care about uplifting people in these communities, are willing to take risks, and can inspire others, particularly the younger generation in the communities.

We believe that at least a few of the initiatives will turn out to be pioneering approaches that collectively help to build the entrepreneurship and innovation-driven frameworks and collaborations that will substantively transform our distressed communities within the next 5 to 10 years.

————–

APPENDIX

Excerpt from: Pooling Our Resources to Foster Black Progress: An Entrepreneurship and Impact Investing Framework (Amazon.com; 2014), by Michael Isimbabi, Ph.D.

On the Excellence and Ventures Transformation Fund (or “EXCEL-TRANSFORM Fund”):

…The billion dollar question is this: If we want to build a national organization that could mobilize and galvanize millions of African Americans (and non-African Americans) to pool resources to foster job creation and wealth building, and be as effective as, say, the civil rights movement was at the height of its achievements, what form should it take and how should we go about setting it up?

….

….

Imagine the instant credibility and captivating attention a fund would garner if a number of personalities, even as few as two or three, such as the following — to name just a few out of several — got together to establish or back one: [Editor’s note: Isimbabi lists the names of several African Americans; insert here, instead, names of your own favorite celebrities, corporate titans, investors, entrepreneurs, philanthropists, and other public personalities who care about revitalizing our communities]

A collective, nationally visible effort by such well-known and well-respected personalities and celebrities — pooling their resources to attack black America’s most critical problems — would obviously have a powerful, galvanizing impact and multiplier and ripple effects on the African American community nationwide. A fund backed by such an ideal “dream team” of African Americans, while desirable, may appear unlikely or infeasible. However, it is not impossible! There obviously are numerous others who are equally reputable and trustworthy, even if less well-known, who can back the Fund and give it the instant credibility it would need. For these highly accomplished people, backing and/or investing in the Fund would simply be a natural extension of the laudable philanthropic work they already do, such as fostering black entrepreneurship, wealth building, educational achievement, job training, etc. and supporting African American arts, museums, and theater.

…..

…..

…[T]he challenges associated with creating and sustaining an initiative such as the Fund, though difficult, can be overcome. We have the resources. There is a strong and increasing recognition of the urgent need for greater self-reliance in the black community and to pool resources strategically for greater impact. Also, further building on an already strong culture of philanthropy, there clearly is a growing energy that is fueling the creation of more collaborative, innovative, and strategic resource-pooling and entrepreneurship-based initiatives to foster progress. And we certainly have the visionaries, business and social entrepreneurs, and innovators who can harness the resources and energy to make a large-scale, transformational, national resource-pooling initiative such as the Fund a reality. Clearly, the time is right for those who believe in this approach – evidently a substantial segment of the black community – to make it happen, and thereby help to finish the “unfinished business” of the civil rights movement!

Excerpt from: After Baltimore: Revitalizing Distressed Communities through Impact Investing and Entrepreneurship (Part III): How Engaged Celebrities and Other Philanthropists, as “Pioneer Investors,” Can Jump-Start an Impact Investment Fund and Galvanize Other Investors and Communities. By Michael Isimbabi. LivingCities.org Blog. December 2015.

…[I]n my eBook, I posit that a group of five to ten successful, philanthropic-minded, respected, and influential people – arts/music/movie/TV/radio/sports/other celebrities, entrepreneurs, corporate and financial professionals, angel investors, etc. – could set up the Fund and hire competent and experienced professionals to run it. Such a first-rate team, by virtue of their accomplishments, credibility, high profiles, and celebrity, would give the Fund the instant credibility, imprimatur and massive publicity necessary to enable it to overcome the trust barrier, galvanize large numbers of investors (potentially in the millions), and thereby raise enough capital to have transformational impact.

Some of these “pioneer investors” would be high-net worth individuals who can provide seed capital to start the Fund, and others could be highly-accomplished personalities who may not be wealthy enough to invest significant amounts but can lend the public respect and credibility they command, e.g., by helping to engage and galvanize communities.

As discussed in my eBook – and well-chronicled by blogs such as BlackGivesBack.com and BlackCelebrityGiving.com – such people already do substantial charitable giving in various ways. However, while they give to many worthy causes, e.g., education, health, poverty, museums, etc., in many cases, it is often difficult to determine the effectiveness of their giving. For example, a recent UBS survey found that “while millionaires highly value charitable giving, they are not confident about the impact of their giving. Only 20% of millionaires rate their giving approach as highly effective, and only 41% are highly satisfied with the impact they have made on their broader communities and society.” Similarly, a U.S. Trust study found that, in 2013, 98.4% of high-net-worth households donated to charity; of these, 53.4% monitor or evaluate the impact of their charitable giving while 46.6% do not, and only 40% of the latter category report achieving their desired impact through their giving.

….[P]eople who are already engaged in philanthropic giving to uplift distressed communities are the most obvious prospective investors in the Fund. To the extent that they are convinced that the Fund, by virtue of its business/entrepreneurship focus and industry-standard transparency and accountability, would have greater impact than “traditional” charitable giving, while also providing them financial returns, some would find the Fund to be a more attractive option for their philanthropy dollars. Furthermore, some may even consider investing in the Fund beyond their normal levels of charitable giving as part of their investment portfolios. Lupe Fiasco’s efforts, and other similar efforts by other celebrities – such as Grammy-winning songwriter/producer Bryan Michael Cox (100 Urban Entrepreneurs and other initiatives) – potentially could inspire more celebrities to become more engaged in impact investing, especially by pooling capital through collaborative partnerships to establish a national, large-scale initiative such as the Fund.

Related:

Black Tech Entrepreneurship: Insights, Perspectives, Initiatives and Trends. BlackProgress.com.

After Baltimore: Revitalizing Distressed Communities through Impact Investing and Entrepreneurship (Part III): How Engaged Celebrities and Other Philanthropists, as “Pioneer Investors,” Can Jump-Start an Impact Investment Fund and Galvanize Other Investors and Communities. Michael Isimbabi. LivingCities.org.

Pooling Our Resources to Foster Black Progress: An Entrepreneurship and Impact Investing Framework. Michael Isimbabi. eBook (Amazon.com).

Senators Booker and Scott and Congressmen Tiberi and Kind Introduce the “Investing in Opportunity Act”. U.S. Senator Cory Booker. Press Release.

Fight Poverty by Investing in Opportunity. U.S. Senator Tim Scott. The State (SC).

Investing With Purpose: Unlocking the Economic Potential of Impact Investments. Bay Area Council Economic Institute.

Unlocking Private Capital To Facilitate Economic Growth In Distressed Areas. Jared Bernstein & Kevin A. Hassett. Economic Innovation Group.

Over 50 Million Americans Live In Economically Distressed Communities. Economic Innovation Group.

The Distressed Communities Index. Economic Innovation Group.

———

Some of the media coverage of the Neighborhood Start Fund:

- Lupe Fiasco And A Waze Exec Make A Million-Dollar Bet On Inner-City Innovators. FastCompany.com

- Could Brownsville be the next startup hub? Technical.ly Brooklyn

- Lupe Fiasco Launches Startup Aimed at Underserved Entrepreneurs. Atlantablackstar.com

- Lupe Fiasco Launches New Non-Profit to Fund Inner-City Entrepreneurs. Thesource.com

- Lupe Fiasco Talks His Quest to Find the Next $100 Million Diamond in the Rough. Upcoming100.com

- Lupe Fiasco’s Looking For The Next Big Idea In The Inner-City. iHeart.com

- The Dream Big Foundation Rewards Entrepreneurship in the Inner City. Liveperson.com

- Lupe Fiasco Talks His Quest To Find The Next $100 Million Diamond In The Rough. Vibe.com

- Lupe Fiasco Is Funding Start-Up Businesses Created by Working-Class Entrepreneurs. TheRoot.com

- Hip Hop Star Lupe Fiasco Launches Nonprofit To Help Entrepreneurs Turn Ideas Into Start-Ups. Urbanintellectuals.com

- Lupe Fiasco starts nonprofit to support entrepreneurs and startups. Rollingout.com