Ariel Investments Black Investor Survey 2010

2010 Ariel Black Investor Survey Shows That in Recession, Middle-Class African-Americans Have Disproportionately Curtailed Saving and Investing

Middle-class African-Americans are more likely than Whites to have curtailed their saving and investing in order to make it through the recession. Even after controlling for various socio-economic factors, Blacks are nearly twice as likely to have reduced their contributions to 401(k) plans relative to Whites.

The survey of 501 Blacks and 505 Whites with household incomes of at least $50,000 found that nearly half of all Blacks (compared to 31% of Whites) dipped into savings to make ends meet in the last two years.

Additionally, 27% of Blacks who participate in a 401(k) (compared to 16% of Whites) reduced the amount they contribute per month, and 22% of non-retired Blacks (compared to 14% of Whites) borrowed or withdrew money from a retirement account. Even after controlling for various socio-economic factors, Blacks are nearly twice as likely to have reduced their contributions to 401(k) plans relative to Whites. The median amount Blacks contribute to their retirement plans is $230 per month, compared to $337 a month contributed by Whites. The median assets Blacks have accumulated in their current retirement plans is about half the amount that Whites have accumulated: $56,000 compared to $106,000.

“In times of economic hardship, people have to make difficult decisions,” said Mellody Hobson, Ariel President. “Unfortunately, the resulting trade-offs mean many in our community are slipping even further behind.”

Since 1998, the survey has consistently found Blacks save and invest less than Whites of similar income levels. This year, the median amount Black households reported saving on a monthly basis is $189, compared to $367 among White households. The 2010 findings mark the first time in a decade that African-American households have reported saving less than $200 per month.

The survey suggests a sober realization of changed circumstances. In past surveys, African-Americans have anticipated retiring much earlier than Whites. In 2006, for example, 40% of Blacks planned to retire before they turned 60, compared to only 22% of Whites. This year, only half as many African-Americans—21%—intend to retire before 60, compared to 14% of Whites.

Additionally, 43% of Blacks and 29% of Whites report making “significant” changes to their lifestyle. Eight in ten African-Americans, and seven in ten Whites, say they have cut back on spending in the last two years.

In contrast, when the economy faltered in the months following 9/11, only about three in ten African-Americans and two in ten Whites said they had been spending less money, according to the 2002 Black Investor Study.

This year’s survey also found about half of African-Americans (and about a quarter of Whites) feel the recession has hurt minorities more than it has hurt Whites.

Additional findings support that perception: 60% of Blacks (compared to 37% of Whites) have been asked for financial help by friends or family; 21% of Blacks (compared to 11% of Whites) increased their credit card debt; and 15% of Blacks (compared to 7% of Whites) asked family or friends for financial help.

Furthermore, 12% of Blacks (compared to 6% of Whites) have not been able to secure a loan for a car or a house; 17% of Blacks (compared to 7% of Whites) are delinquent on a home, car, and/or credit card payment; and 5% of Blacks (compared to 1% of Whites) may go or have already gone into foreclosure.

Investing in the Stock Market

The Black Investor Survey has found year after year that African-Americans are less likely to have money in the stock market than Whites.

……………………………………………………………………………………………………………………………………………………………………

Ariel-Schwab Black Paper: A Decade of Research on African-American Wealth Building and Retirement Planning. October 2007. Ariel Mutual Funds and The Charles Schwab Corporation. Review of 10 years of the Black Investor Survey (1998-2007):

Excerpt from an open letter to the financial services industry, government policymakers, employers and community leaders. Charles R. Schwab, Founder, Chairman & CEO, The Charles Schwab Corporation; John W. Rogers, Jr., Chairman & CEO Ariel Capital Management, LLC / Ariel Mutual Funds; Mellody Hobson, President, Ariel Capital Management, LLC / Ariel Mutual Funds.

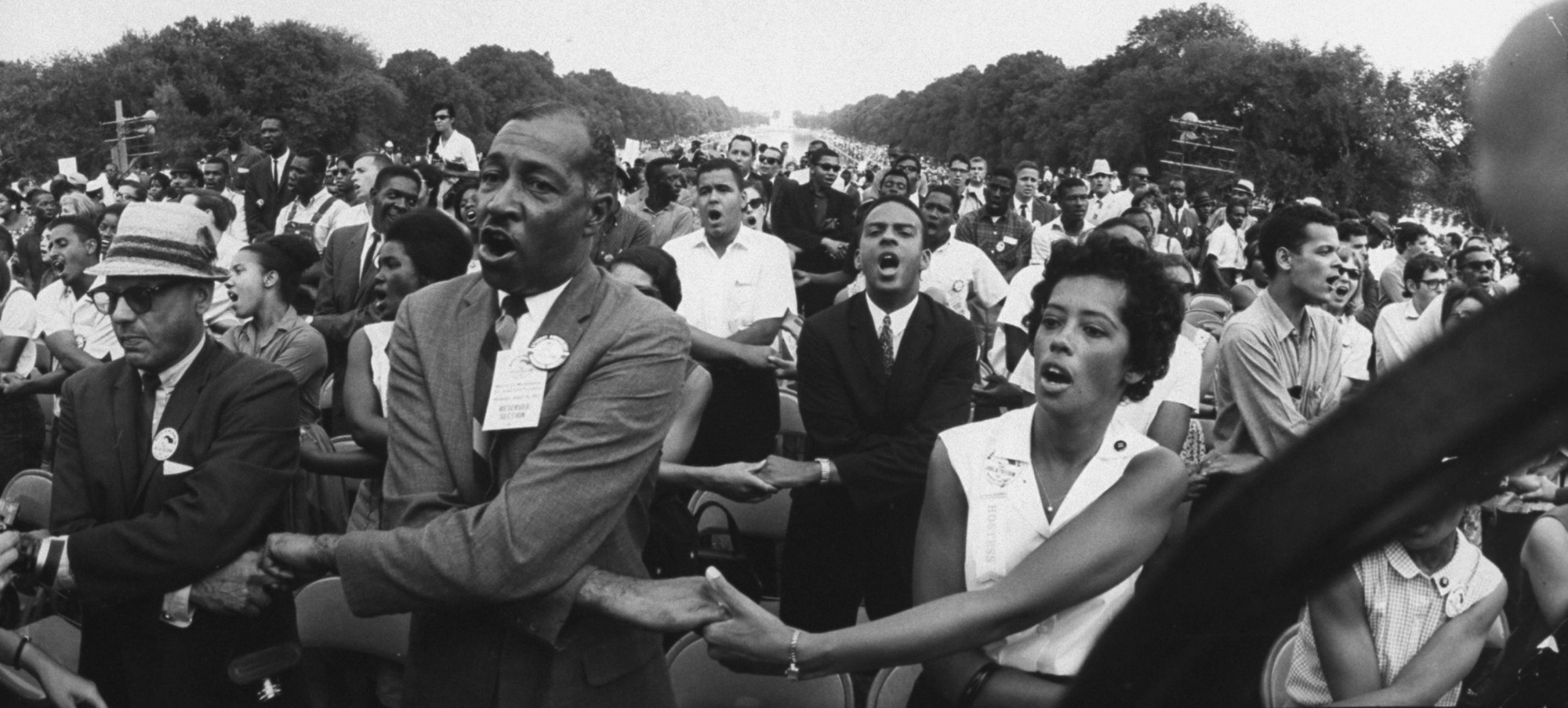

…For middle-class African-Americans, the march toward financial security has been an uphill journey marked by half steps, pauses and, for some, retreat. Over the last decade, Ariel Mutual Funds and The Charles Schwab Corporation have annually commissioned research comparing the saving and investing habits among middle- and upper-income Blacks and Whites.

The results consistently show that Blacks save less than Whites of similar income levels and are less comfortable with stock investing, which impedes wealth building across generations and contributes to an impending retirement crisis in the African-American community. This difficult situation will be worsened by the changing state of America’s pension system, which will hit middle-class Blacks especially hard because of a disproportionate dependence on traditional defined benefit pensions. In short, middle-class Blacks may not be able to realize a key part of the American dream: a comfortable and secure retirement after a job well done.

To mark the survey’s tenth year, Ariel and Schwab are issuing this report on African-American saving and investing. These findings raise several critical questions for a community, an industry and a nation committed to ensuring equal access to the broad benefits of life in the world’s wealthiest country.

What proactive measures can our industry, government, employers and communities undertake to protect middle- and upper-income Blacks from experiencing a profound decline in their financial well-being in their retirement years?

How can we foster a cultural shift toward wealth building that will lead to greater economic opportunities for future generations of African-Americans? And how can we preserve Black economic gains and shrink the wealth gap?

This research suggests that employers play a critical role both in educating Blacks about saving and investing and in ensuring equal participation among all employees; that family and community can facilitate and reinforce the merits of investing; that government — including the education sector — can affect future generations by introducing basic personal finance concepts into every classroom; and that

the financial services industry can serve as the bridge connecting all of these constituencies.

Our hope is this research will spur a national dialogue on the issue of saving and investing, and encourage a collective momentum toward action. If we can elevate the level of saving and investing in one reluctant community, we can make progress in every community, and ultimately reduce poverty and promote opportunity.

Excerpt from survey findings

Blacks trail Whites in savings and stock market participation

Ten years of survey research indicates that middle-to-upper-income African-Americans remain underinvested in the stock market and are no more likely today to be stock investors than they were a decade ago. Whites, on the other hand, are just as likely to be investors today as when the study began.[footnote omitted]

Given their higher rates of involvement in the stock market, it’s no surprise that Whites tend to save more on a monthly basis than their Black counterparts and therefore have accumulated nearly twice as much savings.[footnote omitted]

The savings gap is compounded over time, resulting in Whites having a significantly larger nest egg upon retirement. It is important to note that while Whites have saved considerably more than Blacks, the harsh reality is they, too, are underinvested and ill-prepared for retirement. Nevertheless, the large disparities between Black and White market participation and savings are consistent year over year, even when other demographic factors such as income and education are held constant.

Five years into the survey, the gap between Black and White stock ownership

was narrowing just as the dotcom bubble burst and the terrorist attack of September 11, 2001 occurred. The resulting drop in stock prices in time drove many Blacks to move money away from the market.

By 2003, the percentage of Black investors had dropped dramatically. One of the first surveys asked whether a downturn in the market would prompt a withdrawal of money, and considerably more Blacks than Whites said yes.[footnote omitted] Meanwhile, stock market participation among middle and upper-income Whites has remained remarkably consistent.

Commentary on the Ariel-Schwab Black Paper by Michelle Singletary, the Washington Post’s personal finance columnist:

Study on Savings By Blacks and Whites Reveals Shades of Gray. Michelle Singletary. The Washington Post. 21 Oct 2007

For 10 years, Ariel Mutual Funds and Charles Schwab have issued an annual report on the saving and investing habits of middle- and upper-income blacks. The survey throws a spotlight on the progress of black money-management skills — or lack of progress. It also compares the investing behavior of blacks and whites.

Like many others, I’ve often found reason to comment on the results of the surveys. But now I wonder about the value of comparing the two groups. What exactly do we learn that can help change decades of economic differences? Do these surveys just perpetuate the notion that blacks aren’t taking care of business?

In a special “black paper” marking the 10th anniversary of their survey, Ariel and Schwab came to a sober conclusion. “For middle-class African-Americans,” the report said, “the march toward financial security has been an uphill journey marked by half steps, pauses and, for some, retreat. . . . The results consistently show that blacks save less than whites of similar income levels and are less comfortable with stock investing, which impedes wealth-building across generations and contributes to an impending retirement crisis in the African-American community.”

This year’s Ariel-Schwab Black Investor Survey found that blacks had median investments of $48,000, compared with $100,000 for whites. The survey looks at blacks and whites who earn more than $50,000 annually.

When Schwab and the Chicago-based Ariel, a black-run mutual fund company, first teamed in 1998, 57 percent of blacks and 81 percent of whites said they owned individual stocks or stock mutual funds.

A decade later, that percentage still stands at 57 percent for blacks and has dropped to 76 percent for whites. For the first time, Ariel and Schwab looked at middle- and upper-income black and white retirees. The survey found that retired blacks had a median invested savings of $73,000, compared with $210,000 for whites.

One question in the special report stopped me short. The companies put it this way: “How can we foster a cultural shift toward wealth-building that will lead to greater economic opportunities for future generations of African-Americans?”

Really, is it true that culturally, blacks don’t want to build wealth? Is it a black thing not to believe in investing? Or might it be that their money is being used elsewhere, or that blacks choose other ways to generate income in retirement?

Ariel and Schwab’s surveys suggest it’s not just investing laziness or fear of the stock market that accounts for the percentage difference in total amount invested for retirement. In the 1999 survey, Ariel and Schwab found that African American household incomes must stretch further to support more people, including more school-aged children and extended family members.

In that year’s survey, 27 percent of black respondents said they were financially supporting friends or family beyond those living in their own home. That’s compared with 12 percent of white households. That percentage was consistent in subsequent surveys.

In the 2006 survey, a higher percentage of blacks said they were taking care of adult children or aging parents. That year’s survey also found that blacks who are concerned about saving for their children’s educations or worried about caring for elderly parents are considerably less likely than whites to be saving even $100 per month for retirement.

In this year’s survey, black respondents were again more likely than whites not to be investing because of concerns about paying for education and for day-to-day expenses.

Lost in the headlines is this fact gleaned from the survey: A larger percentage of middle-class blacks than whites work for employers such as the government that tend to provide traditional pensions plans.

In last year’s investor survey, three times as many African Americans as whites (29 percent compared with 10 percent) said they planned to start a business after they retire. Wouldn’t that provide them with needed retirement income?

A higher percentage of blacks than whites own real estate other than their home (42 percent compared with 33 percent), and of these, a greater share of blacks (58 percent compared with 48 percent) say they expect these investments to help fund retirement.

When we look at these surveys, we have to ask who is paying for them. Ariel and Schwab are investment companies. Of course they want to see more people invest. That translates into more business for them.

Still, I believe the overall message from the two companies is valid. Investing is important and should be a key component of a diversified retirement portfolio. It is for me.

What concerns me is the portrayal of blacks as culturally inept at understanding the importance of building wealth for retirement. But as Ariel and Schwab write in the report, “While whites have saved considerably more than blacks, the harsh reality is they, too, are underinvested and ill-prepared for retirement.”

Perhaps it’s time to stop the race comparisons. Maybe we can learn more and significantly help people increase their retirement investments by focusing on the choices individuals make, and the circumstances that compel those choices, without regard to the color of their skin.

………………………………………………………………………………………………………………………………..