Updated, February 2016.

From LivingCities.org:

The imperative, rationale and framework for an impact investment fund specifically targeted to distressed communities:

After Baltimore: Revitalizing Distressed Communities through Impact Investing and Entrepreneurship. By Michael J. Isimbabi, Ph.D.

Part 1: The Imperative and Rationale for an Impact Investment Fund Specifically Targeted to Distressed Communities. Nov 5, 2015.

Part II: A Vision for an Impact Investment Fund Specifically Targeted to Distressed Communities. Nov 12, 2015.

Part III: How Engaged Celebrities and Other Philanthropists, as “Pioneer Investors,” Can Jump-Start an Impact Investment Fund and Galvanize Other Investors and Communities. Dec 10, 2015

Excerpt:

….According to the Fast Company article, [Di-Ann] Eisnor and [Lupe] Fiasco met in May 2014 as Henry Crown Fellows at the Aspen Institute, “hit it off” and started discussing their shared concerns about “inequality in America, ghettoized neighborhoods, and the lack of diversity in the innovation economy. They had a shared belief that good ideas could come from anywhere, and began to wonder whether there wasn’t a way to start hunting for business ideas—and funding them—in neglected neighborhoods around the country.”

Their initiative is consistent with the concept of the EXCEL-TRANSFORM Fund. Indeed, in my eBook [Pooling Our Resources to Foster Black Progress: An Entrepreneurship and Impact Investing Framework], I posit that a group of five to ten successful, philanthropic-minded, respected, and influential people – arts/music/movie/TV/radio/sports/other celebrities, entrepreneurs, corporate and financial professionals, angel investors, etc. – could set up the Fund and hire competent and experienced professionals to run it.

Such a first-rate team, by virtue of their accomplishments, credibility, high profiles, and celebrity, would give the Fund the instant credibility, imprimatur and massive publicity necessary to enable it to overcome the trust barrier, galvanize large numbers of investors (potentially in the millions), and thereby raise enough capital to have transformational impact.

Some of these “pioneer investors” would be high-net worth individuals who can provide seed capital to start the Fund, and others could be highly-accomplished personalities who may not be wealthy enough to invest significant amounts but can lend the public respect and credibility they command, e.g., by helping to engage and galvanize communities.

As discussed in my eBook – and well-chronicled by blogs such as BlackGivesBack.com and BlackCelebrityGiving.com – such people already do substantial charitable giving in various ways. However, while they give to many worthy causes, e.g., education, health, poverty, museums, etc., in many cases, it is often difficult to determine the effectiveness of their giving.

For example, a recent UBS survey found that “while millionaires highly value charitable giving, they are not confident about the impact of their giving. Only 20% of millionaires rate their giving approach as highly effective, and only 41% are highly satisfied with the impact they have made on their broader communities and society.”

Similarly, a U.S. Trust study found that, in 2013, 98.4% of high-net-worth households donated to charity; of these, 53.4% monitor or evaluate the impact of their charitable giving while 46.6% do not, and only 40% of the latter category report achieving their desired impact through their giving.

As I argued in the previous post, people who are already engaged in philanthropic giving to uplift distressed communities are the most obvious prospective investors in the Fund. To the extent that they are convinced that the Fund, by virtue of its business/entrepreneurship focus and industry-standard transparency and accountability, would have greater impact than “traditional” charitable giving, while also providing them financial returns, some would find the Fund to be a more attractive option for their philanthropy dollars.

Furthermore, some may even consider investing in the Fund beyond their normal levels of charitable giving as part of their investment portfolios. Lupe Fiasco’s efforts, and other similar efforts by other celebrities – such as Grammy-winning songwriter/producer Bryan Michael Cox (100 Urban Entrepreneurs and other initiatives)– potentially could inspire more celebrities to become more engaged in impact investing, especially by pooling capital through collaborative partnerships to establish a national, large-scale initiative such as the Fund….. Continue reading

Related:

- PODCAST: Revitalizing Communities Through Impact Investing. Goldman Sachs. On this episode of Exchanges at Goldman Sachs, Margaret Anadu, a managing director in the Urban Investment Group at Goldman Sachs, discusses impact investing and the firm’s efforts to help rebuild communities in Newark and New York City.

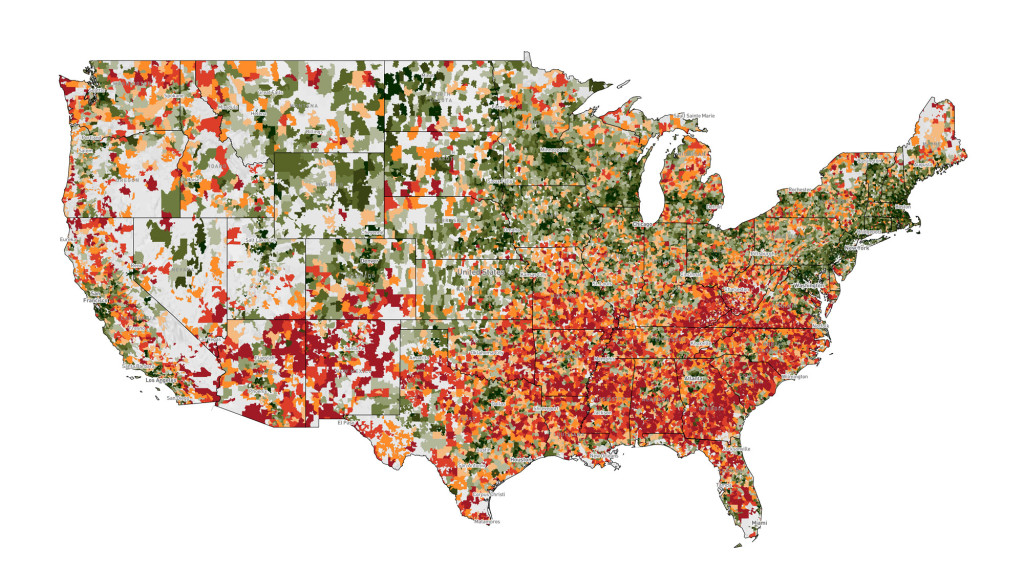

- The Distressed Communities Index (DCI) is a customized dataset created by the Economic Innovation Group examining economic distress throughout the country and made up of interactive maps, infographics, and a report.