Excerpts: Lisa Hall, President/CEO of Calvert Foundation, on the potential of impact investing to transform underserved communities

Lisa Hall of the Calvert Foundation on Impact Investing: An In-depth Interview. Forbes.com. October 20, 2011.

Lisa Hall of the Calvert Foundation on Impact Investing: An In-depth Interview. Forbes.com. October 20, 2011.

….Rahim Kanani: How can we convince traditional investors to reevaluate their portfolios and consider social impact investing?

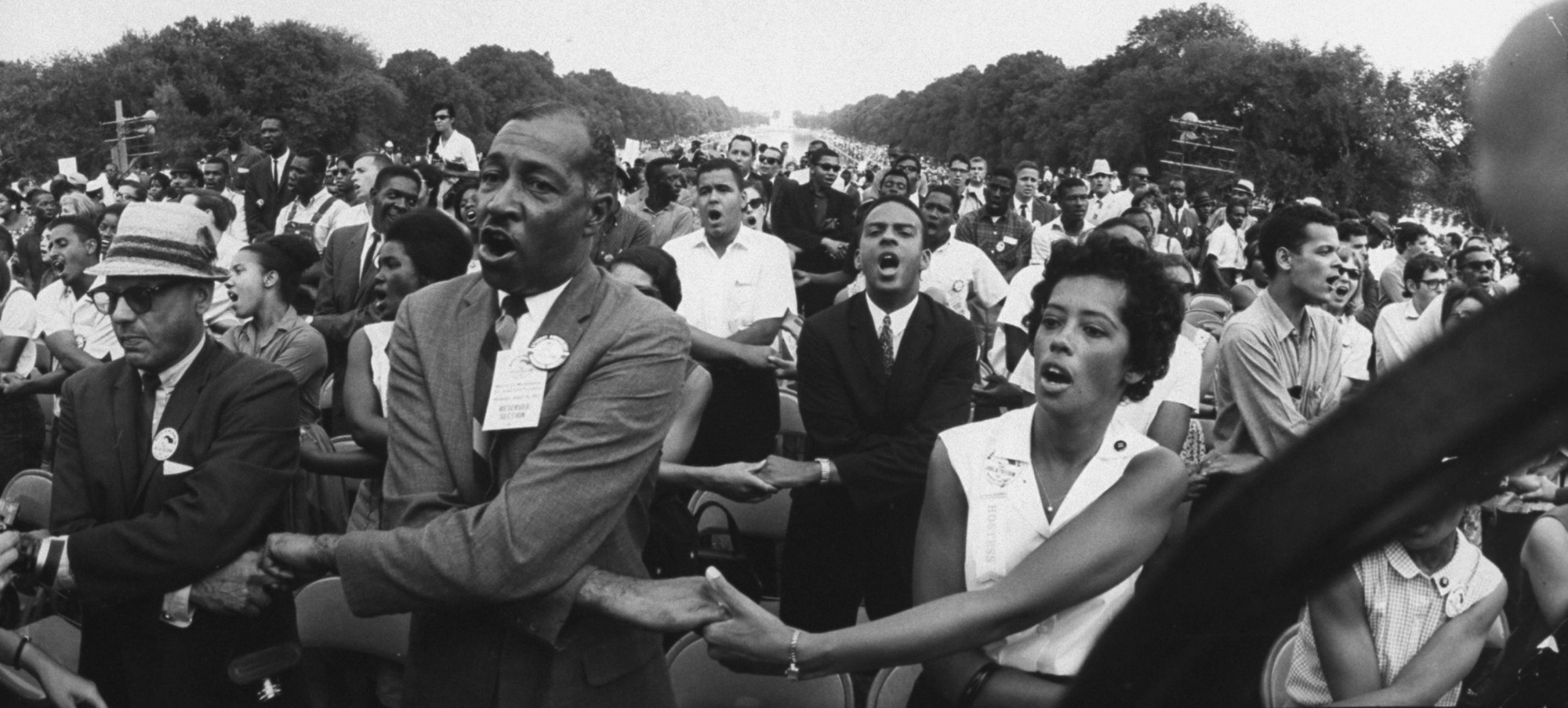

Lisa Hall: I thought about this a lot at the Congressional Black Caucus Foundation’s annual conference, where I spoke about impact investing and the widening wealth gap. During the past few years, our economy has suffered greatly and yet the wealth keeps building at the top. Impact investment creates a virtuous circle of empowerment, opportunity, and engagement by connecting investors, underprivileged individuals, and communities. We need more people to get involved in impact investing because it is a critical part of the solution to closing the wealth gap. ….

*******

Sixteen years ago, Calvert Foundation was born of a seemingly improbable idea: using investment dollars to help end poverty.

Today, investment banks describe impact investing as an “emerging asset class”;… the impact investing market is estimated to raise at least $500 billion in the next decade;…and according to Calvert Foundation’s recent research survey, 72 percent of financial advisors are interested in offering impact investing products to clients….

Impact investing is undoubtedly an idea whose time has come. As budgets of philanthropies and governments have shrunk, investment capital has come to be recognized as a tool that can address some of the world’s most pressing problems.…..

Our Theory of Change: The Democratization of Investment Capital

Calvert Foundation’s objective is to “democratize” social investment capital—enabling underserved communities to gain access to financial products and services, and making it easier for individual investors to participate in financing community development. Put another way, we are empowering investors to empower communities.

We believe that we are at the forefront of a movement to harmonize investors’ money with their values. Calvert Foundation raises capital through the sale of our Community Investment Note, and then invests that capital in organizations around the world that create positive social, economic and environmental impact. The Community Investment Note, starting at 20 dollars, is available in various terms and rates up to 2 percent, and is the only impact investing product that can be purchased through a brokerage account by retail investors. We have provided more than $400 million in loans to help low-income communities around the world, while maintaining a 98.8 percent repayment rate from our borrowers, and a 100 percent repayment rate to all investors. …..

*******

Throughout the course of this year, I have found myself attending numerous conferences and participating in panel discussions where attention has been focused on impact investing. I believe that in 20 years we will look back and consider these past few years as the turning point in an economic movement. Looking forward to the next 20 years, there are many, myself included, who are convinced that we are experiencing a paradigm shift. A change in cultural norms and expectations that will result in all investors — individual and institutional — committing at least some portion of their investable assets to social impact and making investments that are in harmony with their values.

A True Investment

When I joined Calvert Foundation in 2005, impact investing – investing for a financial and social return – was still a very new concept but was steadily gaining popularity. Back then we called it “community investing.” Call it what you will, this type of investing remains a core part of socially responsible or sustainable investing. What makes impact investing different is that we are not investing in publicly traded companies, but instead in organizations which help people to improve their lives through affordable housing, jobs, community services such as daycare and healthcare, and more.

When I say investment, I mean it in the truest sense. Calvert Foundation makes it possible for everyone – from individual investors in increments of $20 to large corporations in amounts as high as $20 million – to invest in low-income communities and provide capital where there is none. We enable Impact Investing through our Community Investment Note, which then directs capital to help finance affordable housing, charter schools, health centers, Fair Trade coffee co-ops, and job creation. These investments in the future of our country and our world are helping to transform the lives of individuals and families. At the same time, investors receive a return on their investment of up to 2 percent. This blended value investment generates both a social and financial return.

Thankfully, we are not alone in our efforts today. The idea that you can invest in socially responsible endeavors and get a return on that investment was radical when we initially conceived of it. Now it is a concept at the very forefront, influencing how investors think about risk, return and rewards. Calvert Foundation recently commissioned a study involving 1,065 financial advisors; 72 percent said they had interest in offering products that provide sustainable investment to their clients, while 38 percent expressed strong interest in being able to offer those products now. The advisers surveyed indicated that they were willing to recommend impact investments to one-third of their clients, dedicating 10 to 20 percent of their portfolios to this type of investing. Based on these numbers, the study estimates a sustainable investment market of about 2.5 percent of advisers’ assets under management, or $650 billion. The change that these dollars can make is both monumental and within the scope of our imagination, our expectations and our ability.

By working with financial advisors and transacting through multiple brokerage firms, we have enabled investors to hold the Community Investment Note in their investment portfolios. Through our partnership with Microplace, an eBay company started in 2007, we have made it possible for investors to purchase Notes online, starting as low as $20. Investors can also come to us directly, opening a Note through an application and simply writing a check. We know that we have to do more to engage and educate investors in order to grow our investor base beyond 10,000 people. In the years to come, we will continue to increase the distribution of our Note – and additional investment products as we develop them – through more and more mainstream brokerage firms. We are also developing strategies to bring new investors into the fold. For example, we want to engage the millennial generation through partnerships with colleges and universities, social media outlets and networking events. We are also embarking on efforts to connect diaspora communities and enable individuals to invest in their countries of origin. Other special initiatives that we envision for the future include regional initiatives. Imagine a program that allows anyone to invest in community projects that help to rebuild America, create jobs and improve critical services in distressed areas like Detroit. ……

Aligning Our Money with Our Values

Taking part in this movement is not simply our individual and collective responsibility; it also creates mutual benefit for investors and the recipients of these investments. It’s time to align our money with our values – to have our money working in harmony with what we believe and not against what we believe.

Anyone can do so by investing as little as $20 in women’s economic empowerment on Microplace. You can serve as a mentor to an entrepreneur just starting out. You can give to a community organization providing job training. At Calvert Foundation we believe that Impact Investing represents the best of what we can be as a society — not for the 99 percent or for the 1 percent, but for the 100 percent. Economic recovery rests on ensuring sustainable access to capital, both to grow existing businesses and to finance new ventures and innovation. Through groundbreaking mechanisms, promising models are actively supplying much-needed capital to small businesses and economic development projects. In some cases, these models are also demonstrating new and sustainable ways to grow wealth and to help communities adapt to a changing economy.

The numbers of people left behind by traditional financial systems is growing – but over the next 20 years we can reverse this trend. Our current financial systems are just not enough to meet the challenges and needs of these turbulent times. Calvert Foundation offers a solution through our Community Investment Note. We encourage everyone to take part and participate in this simple solution that creates economic opportunity for all.

Related:

- The BlackProgress.com essay, Financing Black Progress, Part 2: A Self-Reliance “Marshall Plan”: Creating a National Resource-Pooling Fund, discusses impact investing in the context of a national resource-pooling “impact fund” that can attract investments from millions of black investors.

- Pooling Our Resources on a Large, Transformative Scale: Breaking Through the Trust Barrier

- Stephen DeBerry on the Power of Impact Investing to Foster Black Progress

Great article!